Liquidations

Liquidation is initiated when a borrower's health factor falls below 1, indicating that their collateral value inadequately covers the loan/debt value. This situation can arise from a decline in collateral value or an increase in the borrowed debt value relative to each other. During liquidation, up to 50% of the borrower's debt is settled, with that amount, along with a liquidation fee, being deducted from the available collateral. Consequently, the liquidation process ensures that the liquidated debt is repaid.

To avoid liquidation, users should seek to maintain a high health factor. Users may raise their health factor by either:

- Depositing more collateral, or

- Repaying part of their debt

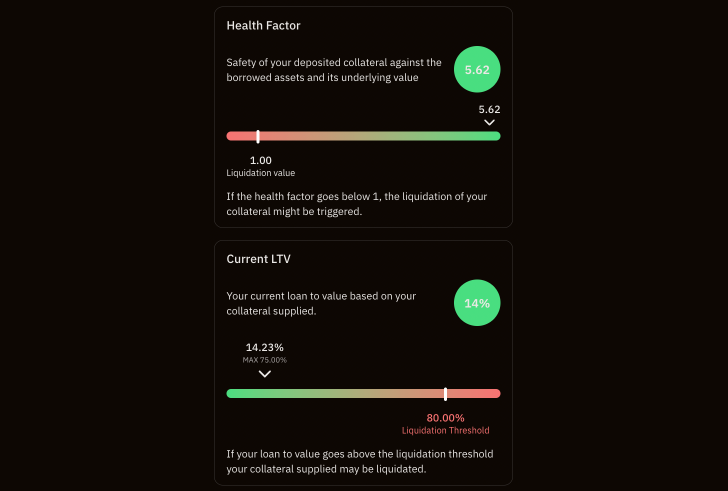

The Bend UI provides a visual health factor indicator to help users monitor their health factor and take appropriate action.

Liquidation Triggers

Health Factor

Where:

represents the health factor (HF) denotes each individual collateral asset represents the sum over all collateral assets

The condition for potential liquidation is: When

Liquidators

Whenever there is a lending position with an HF < 1, liquidators can repay 50% of the user's $HONEY debt, and collect the equivalent value of collateral. An additional 5% bonus on liquidated amounts is deducted from the borrower's collateral and given to the liquidator, as incentive for maintaining the protocol's solvency.

Liquidations are open to anyone, but there is a lot of competition. Normally liquidators develop their own solutions and bots to be the first ones liquidating loans to get the liquidation bonus. You can find more details in the developers section.

Example

Suppose Bob deposits 1000 $HONEY worth of ETH and borrows 700 $HONEY. Assume the liquidation threshold is 80% for ETH collateral.

This means that Bob's current health factor is:

If the price of ETH drops by 13%, such that Bob's health factor falls below 1, his loan will be eligible for liquidation (HF = 0.994). A liquidator can repay up to 50% of the borrowed $HONEY. In return, the liquidator can claim the equivalent ETH collateral plus the liquidation bonus (5%). For the full 50% liquidation, the liquidator claims 350 + 17.5 = 367.5 HONEY worth of ETH for repaying 350 $HONEY.