Interest Rates

The Bend protocol mitigates risk by controlling borrowing interest rates.

Bend's variable interest rates are determined primarily by the protocol's utilization ratio $HONEY to the total supplied $HONEY:

U = Total Borrowed / Total Supplied

There is an Interest Rate Model which controls the borrowing costs of $HONEY on Bend:

- The model incentivizes users to borrow

$HONEYwith low interest rates when the protocol is underutilized. - The model disincentivizes borrowing

$HONEYwhen the protocol is overutilized (with high interest rates).

The interest rate is calculated using the following formula:

When

When

There is an optimal utilization

Interest Rate Examples

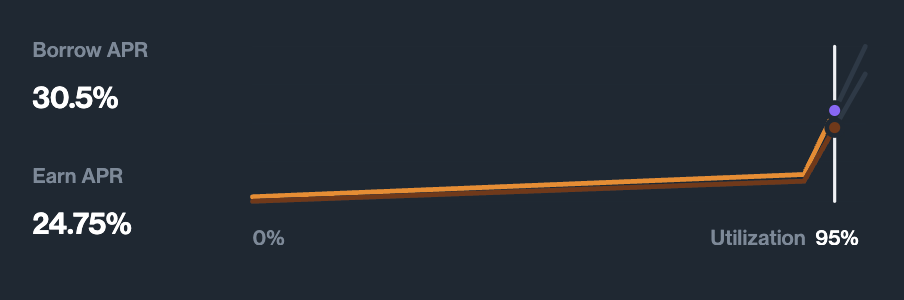

The interest rate curve resembles a "hockey stick graph", where the graph turns upward sharply after the optimal utilization ratio is reached. Higher borrowing APRs also translate to higher interest rates for $HONEY suppliers. The spread between the two rates reflects the fees which are collected and paid to $BGT stakers.

WARNING

These examples are illustrative and do not reflect the actual interest rate model parameters

Low/Normal Utilization

70% utilization example:

High Utilization

95% utilization example:

Interest Rate Model Parameters

WARNING

Best efforts are made to keep these parameters up to date, but they are subject to change by governance. Consult the UI or contracts for the latest parameters.

Below are the parameters for the $HONEY borrowing market:

| Parameters | Value |

|---|---|

| Optimal Usage | 80% |

| Base Variable Borrow Rate | 0 |

| Variable Rate Slope 1 | 4% |

| Variable Rate Slope 2 | 75% |

| Base Stable Borrow Rate | 1% |

| Stable Rate Slope 1 | 0.5% |

| Stable Rate Slope 2 | 75% |