Interest Rates

Understanding how interest rates are determined and how they affect a borrower's position is fundamental to building a safe and transparent borrow integration. In Bend, the interest a borrower pays is dictated by the market's Interest Rate Model (IRM).

The Role of the Interest Rate Model (IRM)

Each Bend Market is created with a specific, immutable IRM. This smart contract contains the logic that dynamically calculates the borrow interest rate based on market conditions, primarily the utilization rate.

- Utilization Rate: The ratio of total borrowed assets to total supplied assets in a market.

Utilization = Total Borrows / Total Supply - Approved IRMs: Only IRMs that have been approved by Bend Governance can be used to create new markets. Currently, the primary model is the

AdaptiveCurveIRM.

The AdaptiveCurveIRM

The AdaptiveCurveIRM is designed to maintain market utilization around a target of 90%.

- When utilization < 90%: The borrow rate gradually decreases to incentivize more borrowing.

- When utilization > 90%: The borrow rate rapidly increases to encourage repayments and attract more supply.

This mechanism ensures that markets remain capital-efficient while having enough liquidity for withdrawals.

For a deeper dive into the mathematical formulas and adaptive mechanics, see the IRM Concept Page.

Determine Market AdaptiveCurveIRM

To find the rate at target utilization for each market you will need to check 2 contracts:

- Morpho Contract - To retrieve IRM for market

- IRM Contract - Query rate at utilization point (e.g. 80%)

With the assumption that we'll use one of the following markets:

| Market | MarketId |

|---|---|

| wsRUSD / HONEY | 0x04d3b8b00c6f3b75481492b76139473e2368339ee58587df65684fdb9103984e |

| WBTC / HONEY | 0x950962c1cf2591f15806e938bfde9b5f9fbbfcc5fb640030952c08b536f1f167 |

| sUSDe / HONEY | 0x1ba7904c73d337c39cb88b00180dffb215fc334a6ff47bbe829cd9ee2af00c97 |

| wgBERA / HONEY | 0x63c2a7c20192095c15d1d668ccce6912999b01ea60eeafcac66eca32015674dd |

| WETH / HONEY | 0x1f05d324f604bd1654ec040311d2ac4f5820ecfd1801a3d19d2c6f09d4f7a614 |

| WBERA / HONEY | 0x147b032db82d765b9d971eac37c8176260dde0fe91f6a542f20cdd9ede1054df |

| iBERA / HONEY | 0x594de722a090f8d0df41087c23e2187fb69d9cd6b7b425c6dd56ddc1cff545f0 |

Step 1 - Determined IRM Contract

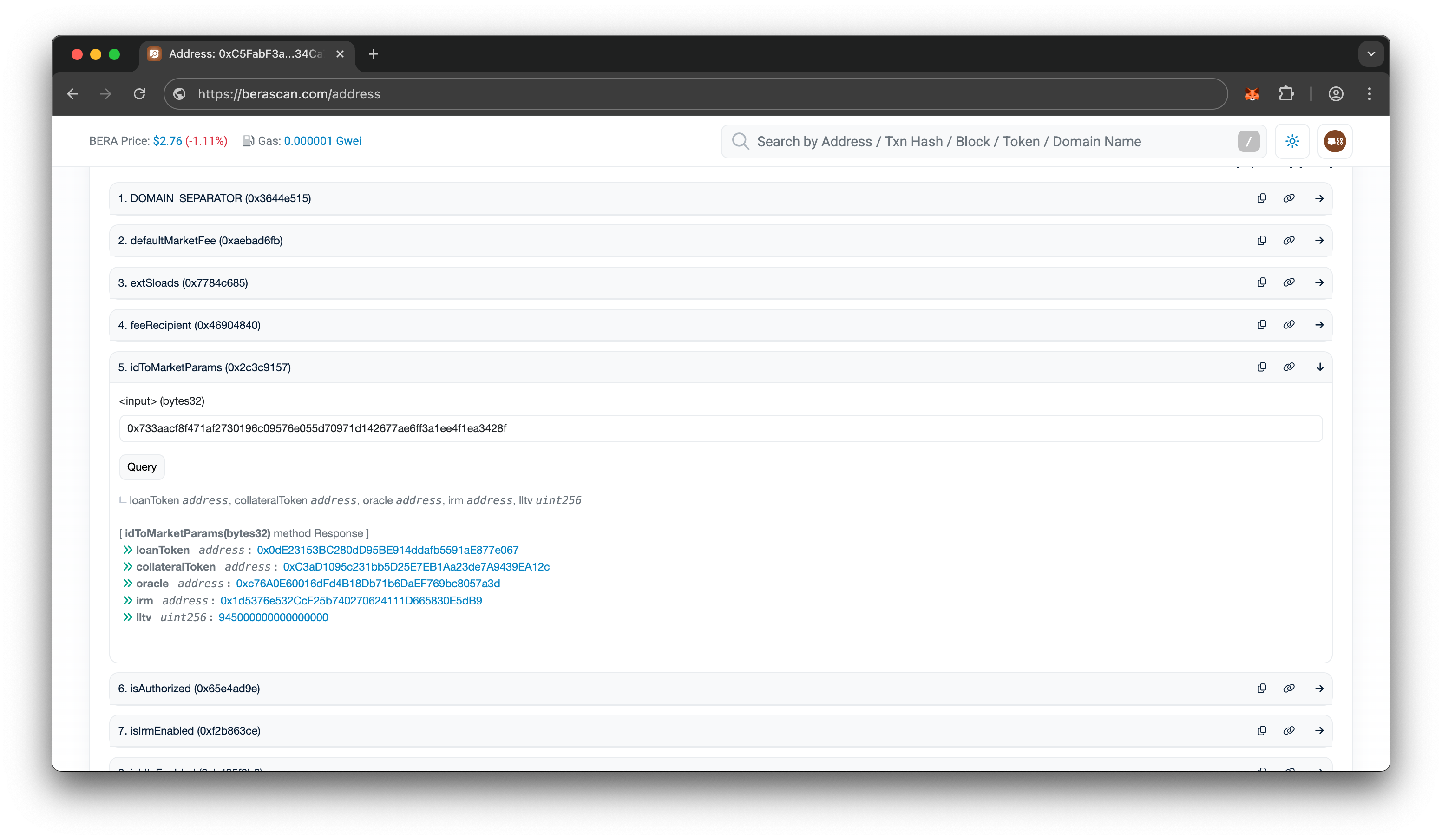

Go to https://berascan.com/address/0x24147243f9c08d835C218Cda1e135f8dFD0517D0#readContract and enter one of the MarketIds from above in the idToMarketParams field.

Returned should provide something similar to the following:

| Name | Type | Value |

|---|---|---|

| loanToken | address | 0x0dE23153BC280dD95BE914ddafb5591aE877e067 |

| collateralToken | address | 0xC3aD1095c231bb5D25E7EB1Aa23de7A9439EA12c |

| oracle | address | 0xc76A0E60016dFd4B18Db71b6DaEF769bc8057a3d |

| irm | address | 0x1d5376e532CcF25b740270624111D665830E5dB9 |

| lltv | uint256 | 945000000000000000 |

Take note of the irm address and go to that address on https://berascan.com/.

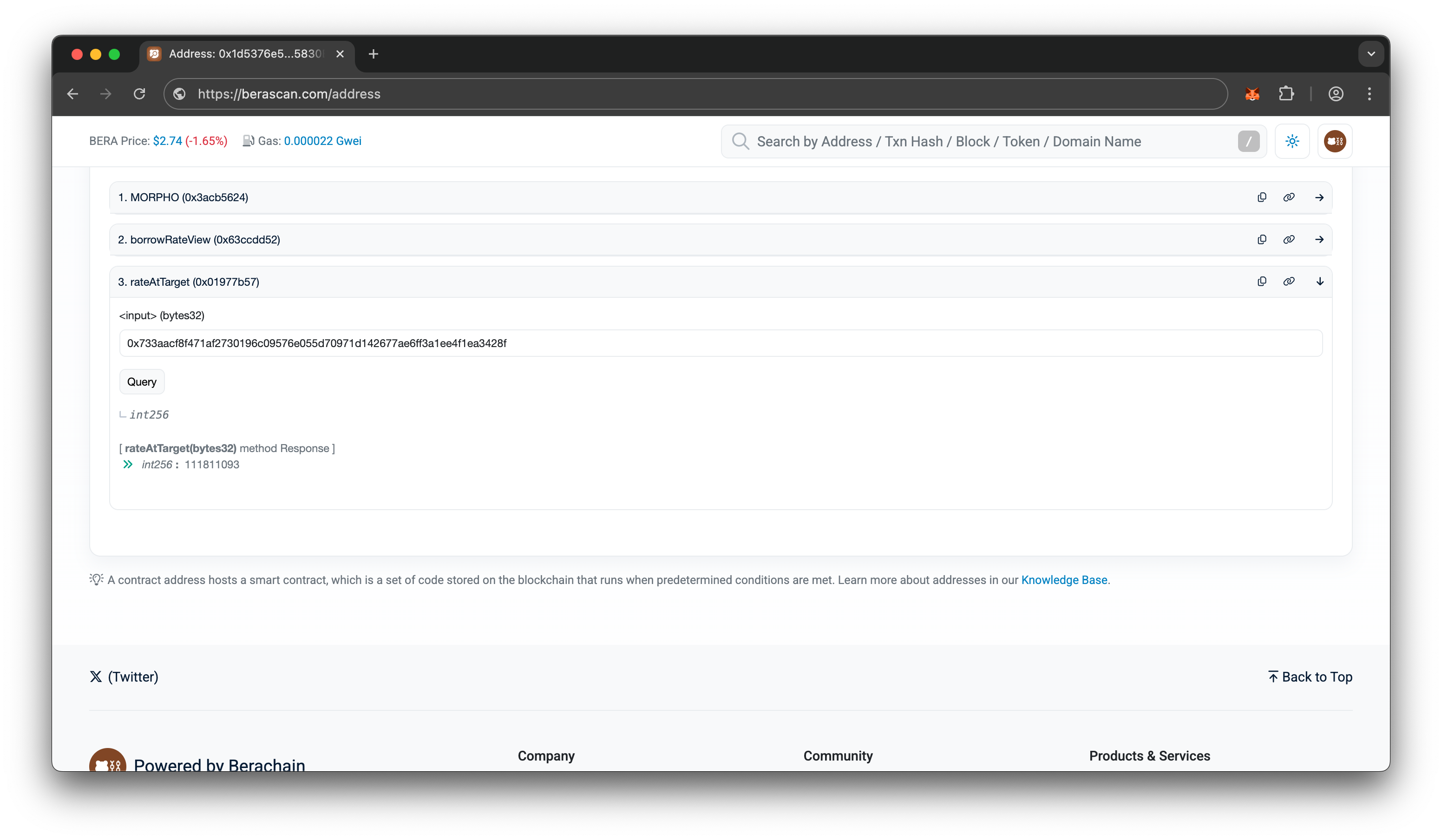

Step 2 - Determine Market Rate Target Utilization

Enter one of the MarketIds from above into the rateAtTarget field.

How Interest Accrues on Debt

For a borrower, the most important takeaway is that interest is constantly accruing, increasing their total debt over time. This directly impacts their position's health.

The process is as follows:

1. Rate Calculation

The IRM calculates the instantaneous borrowRate based on the market's current utilization.

2. Interest Accrual

This rate is applied to the borrower's debt continuously. The amount of interest accrued increases the totalBorrowAssets in the market and, proportionally, the asset value of each borrower's borrowShares.

3. Impact on Health Factor

As the debt value increases due to accrued interest, the user's LTV rises and their Health Factor falls, even if collateral and asset prices remain stable.

Health Factor = (Collateral Value × LLTV) / (Initial Debt + Accrued Interest)

This is a critical concept to communicate to users: their position can become riskier over time simply from interest accrual.

Onchain State and accrueInterest

The Bend contract does not update interest for every block to save gas. Instead, interest is calculated and applied only when a market interaction occurs via the _accrueInterest internal function. This function is triggered by actions like borrow, repay, supply, and withdraw.

What this means for your integration:

When you fetch a user's position from the contract, the totalBorrowAssets value reflects the state at the last interaction. To get the up-to-the-second debt value, you must account for the interest accrued since the lastUpdate timestamp.