Borrowing

Why would I borrow instead of selling my assets?

Liquidation of your assets implies closing your position on that particular asset. Therefore, if you are holding a long position in the asset, you would not be able to capitalize on potential upside value gains. Borrowing, on the other hand, provides a means to access liquidity (working capital) without liquidating your assets. Users typically borrow for unforeseen expenses, leverage their holdings, or explore new investment opportunities.

How do I borrow?

Before borrowing you need to supply stable assets to be used as collateral. Head over to Supplying section to learn how to supply.

Note:

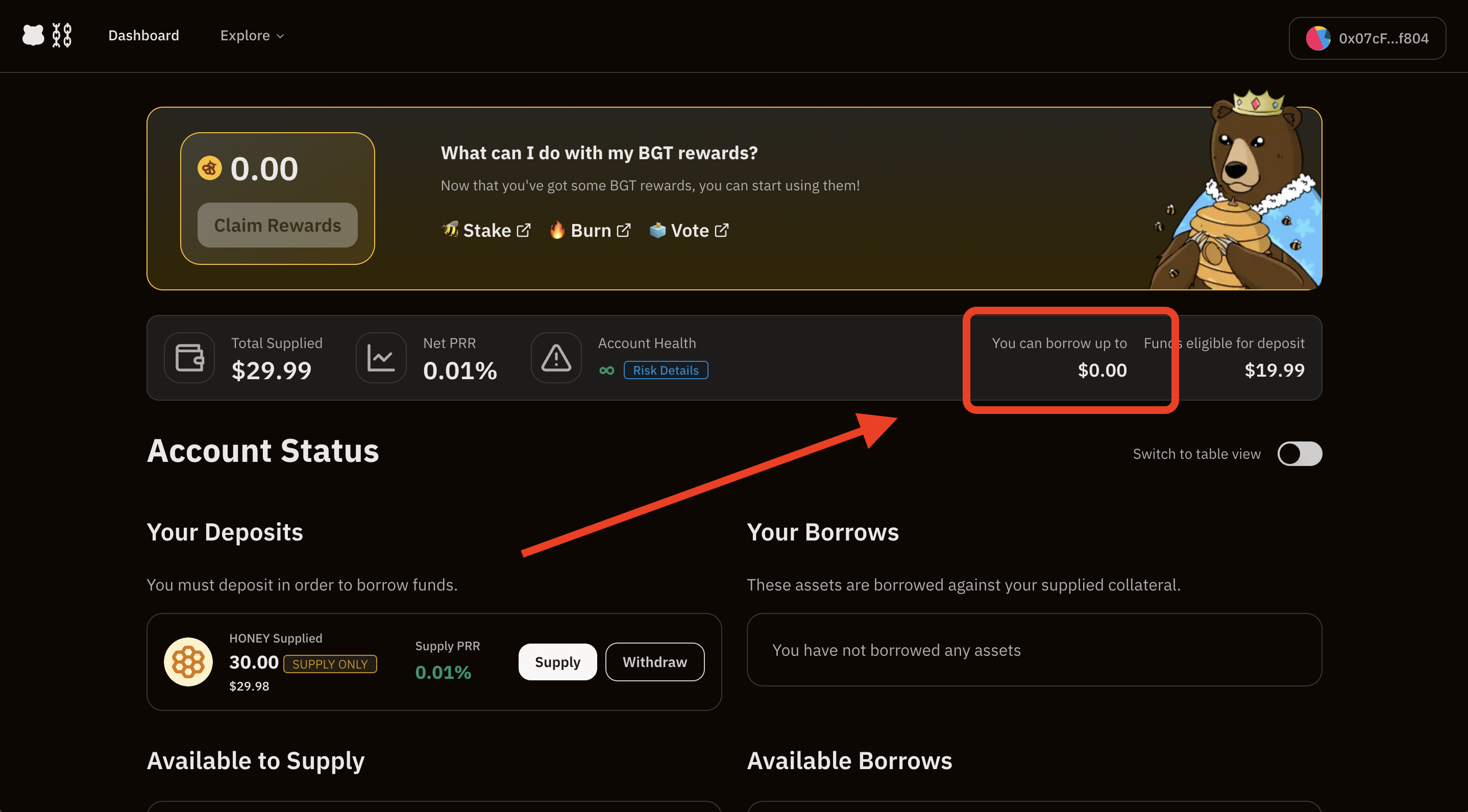

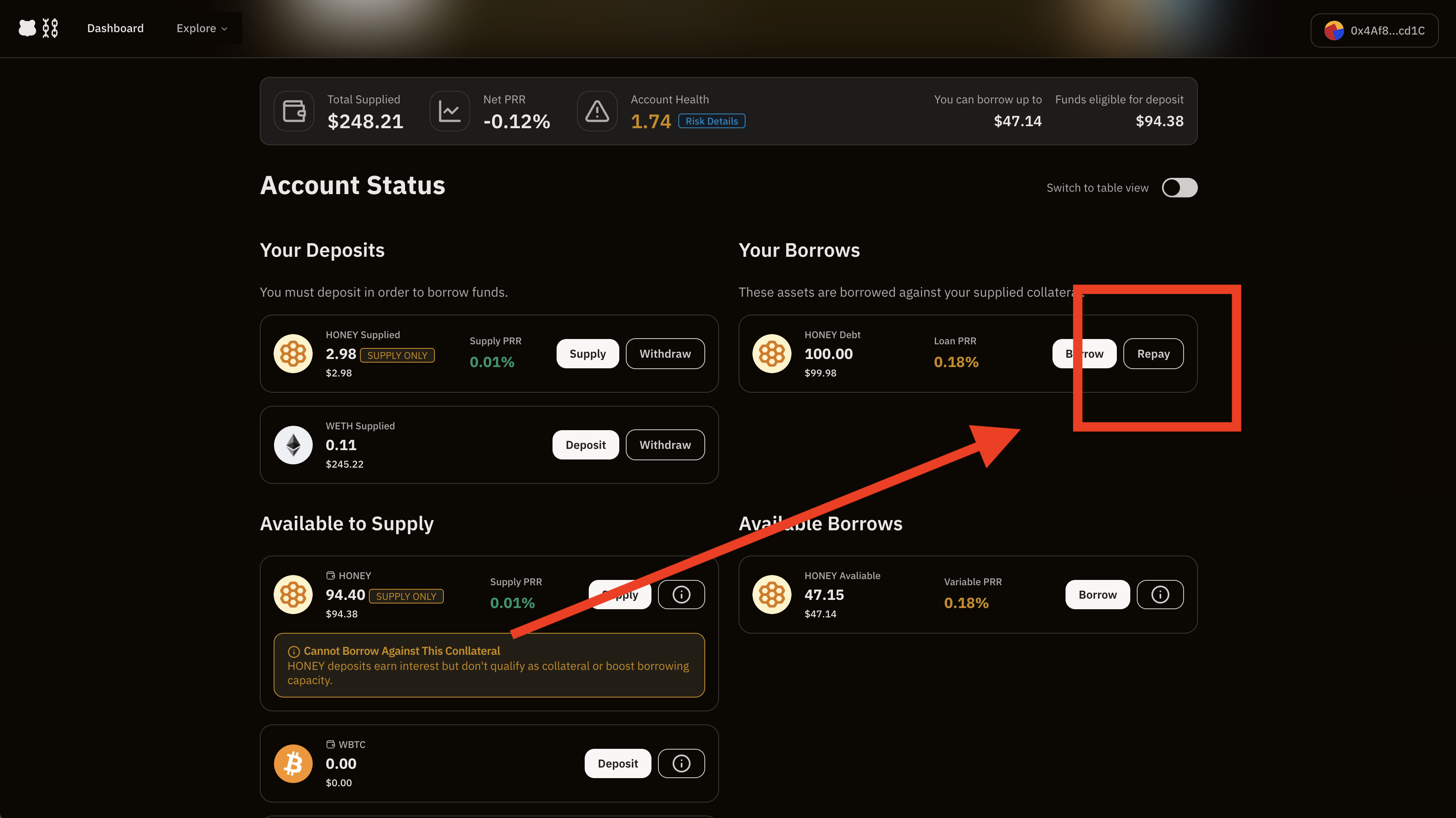

$HONEYcannot be used as collateral for borrowing.

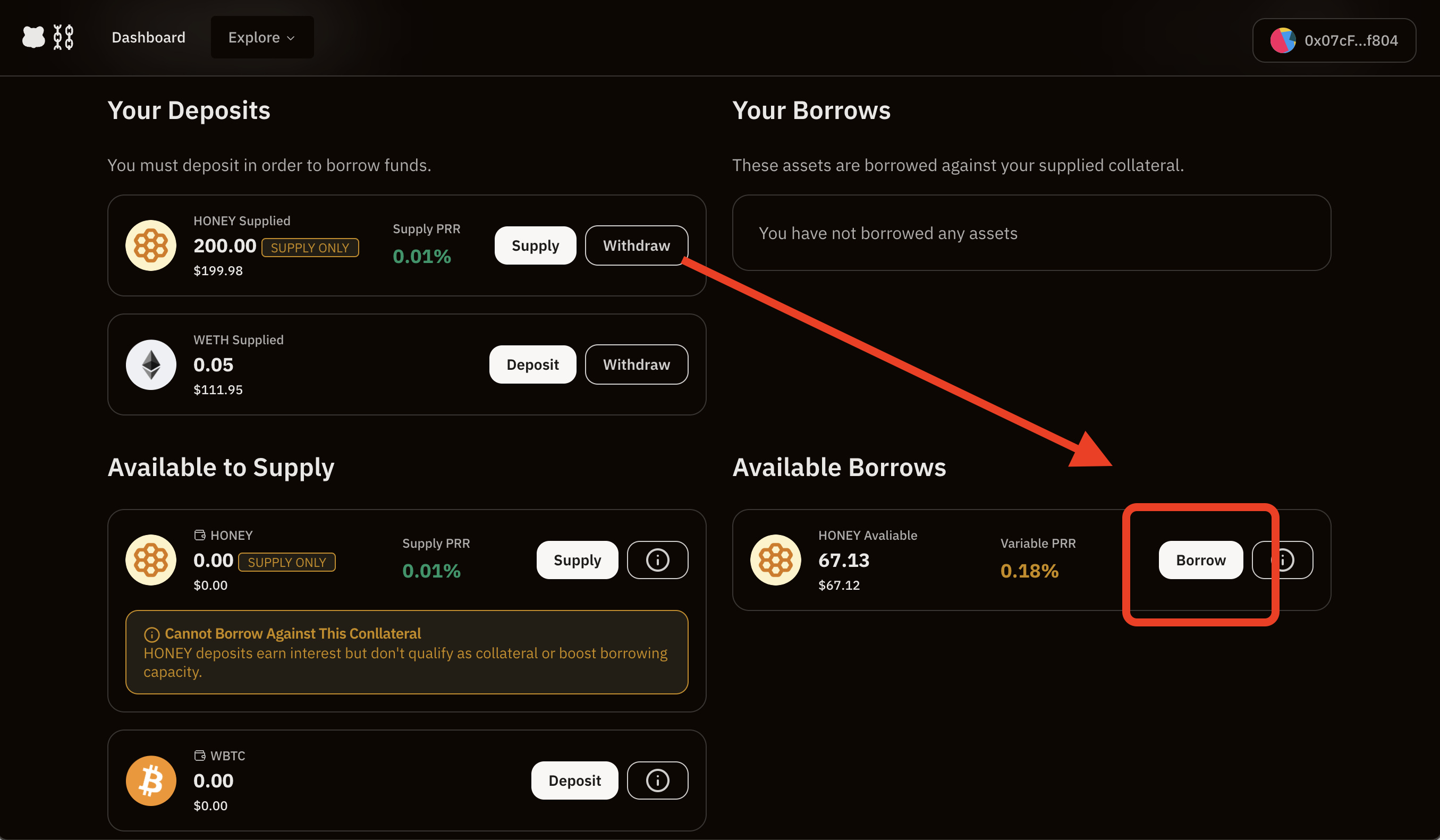

Initiate Borrow

Head to the main dashboard section and click on “Borrow” for the asset you want to borrow.

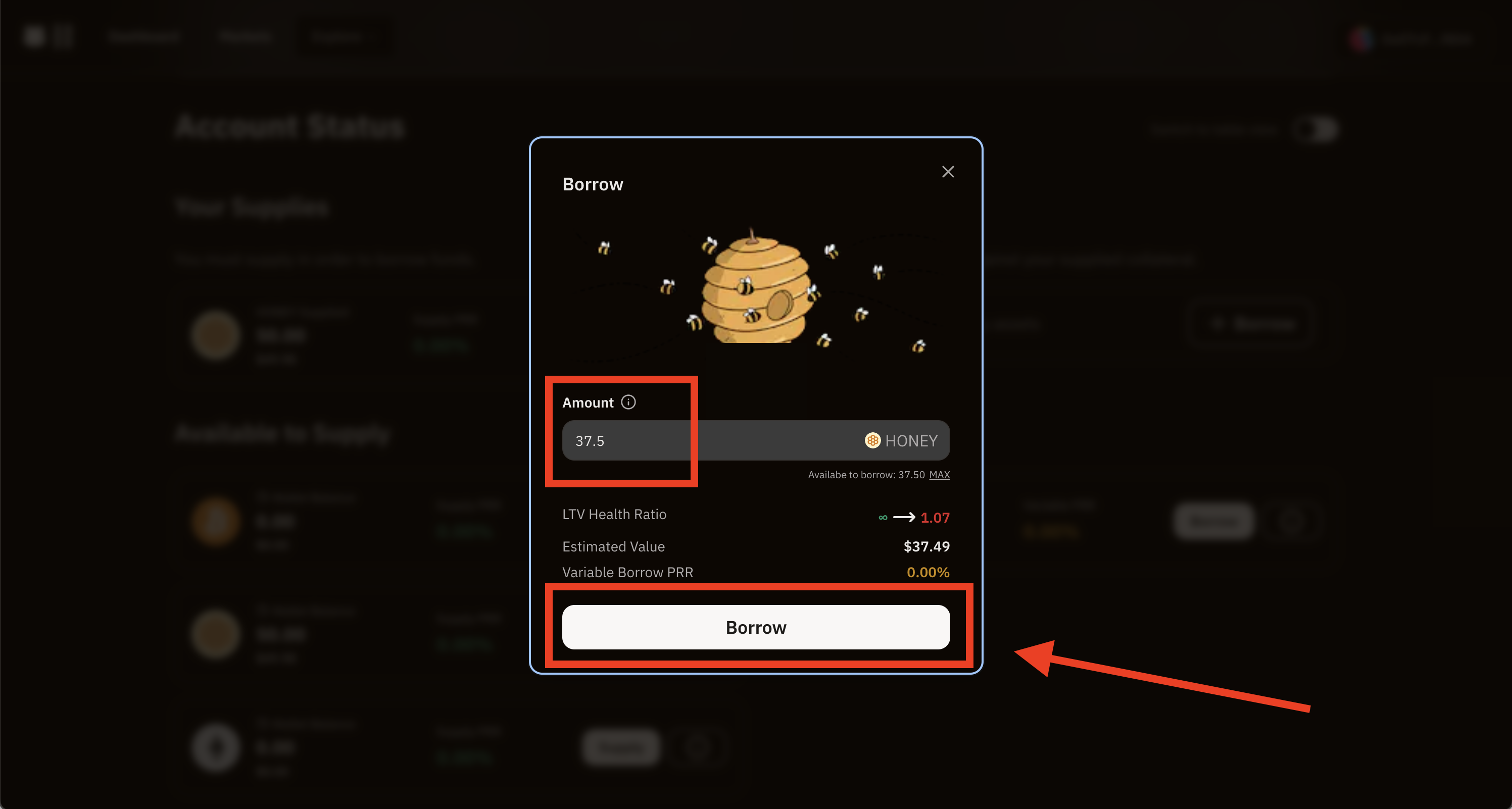

Set Borrow

Set the amount you need based on your available Borrows.

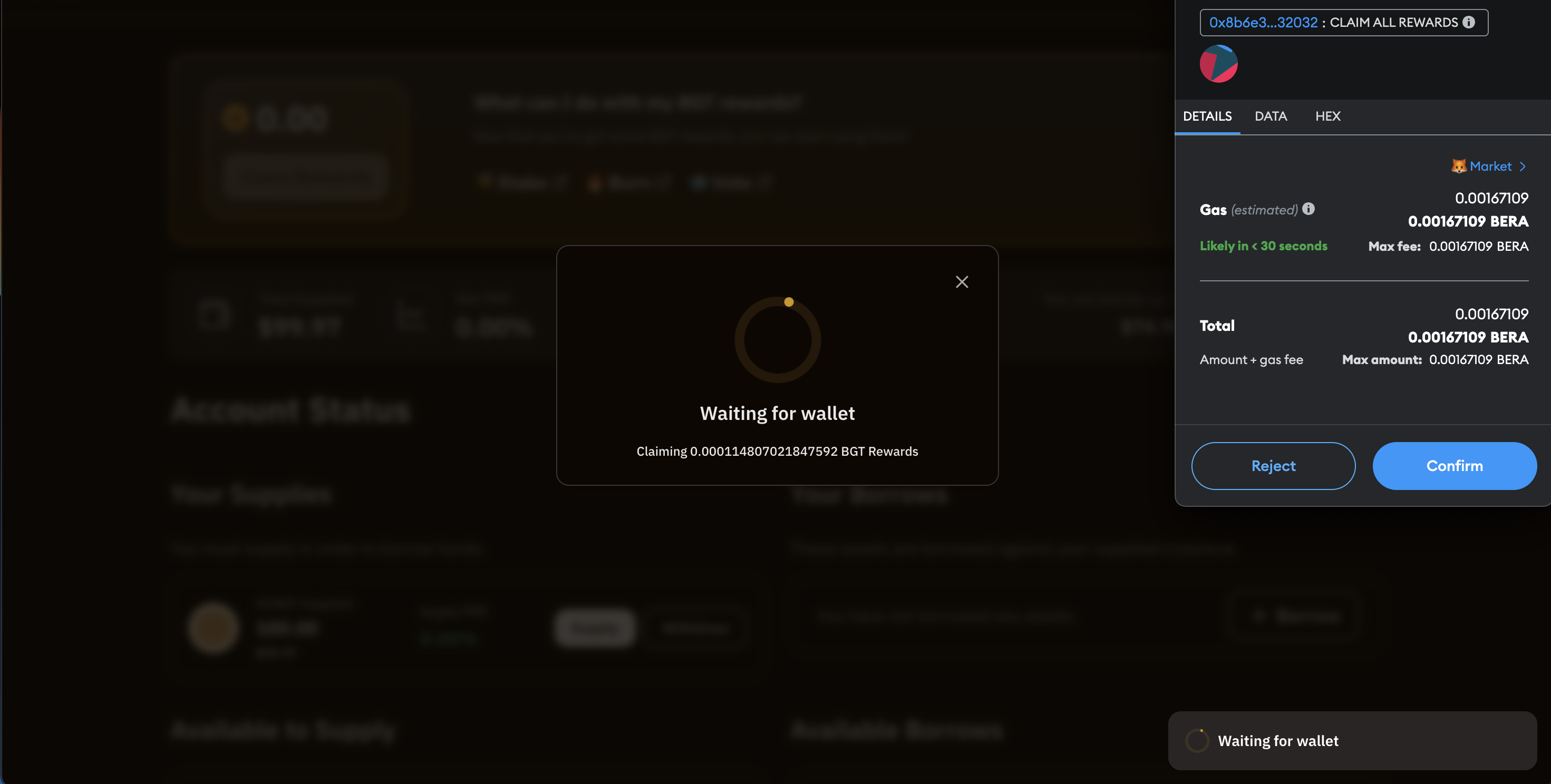

Confirm Borrow

Confirm the amount of that particular asset to borrow, click on Borrow. Confirm the transaction on wallet.

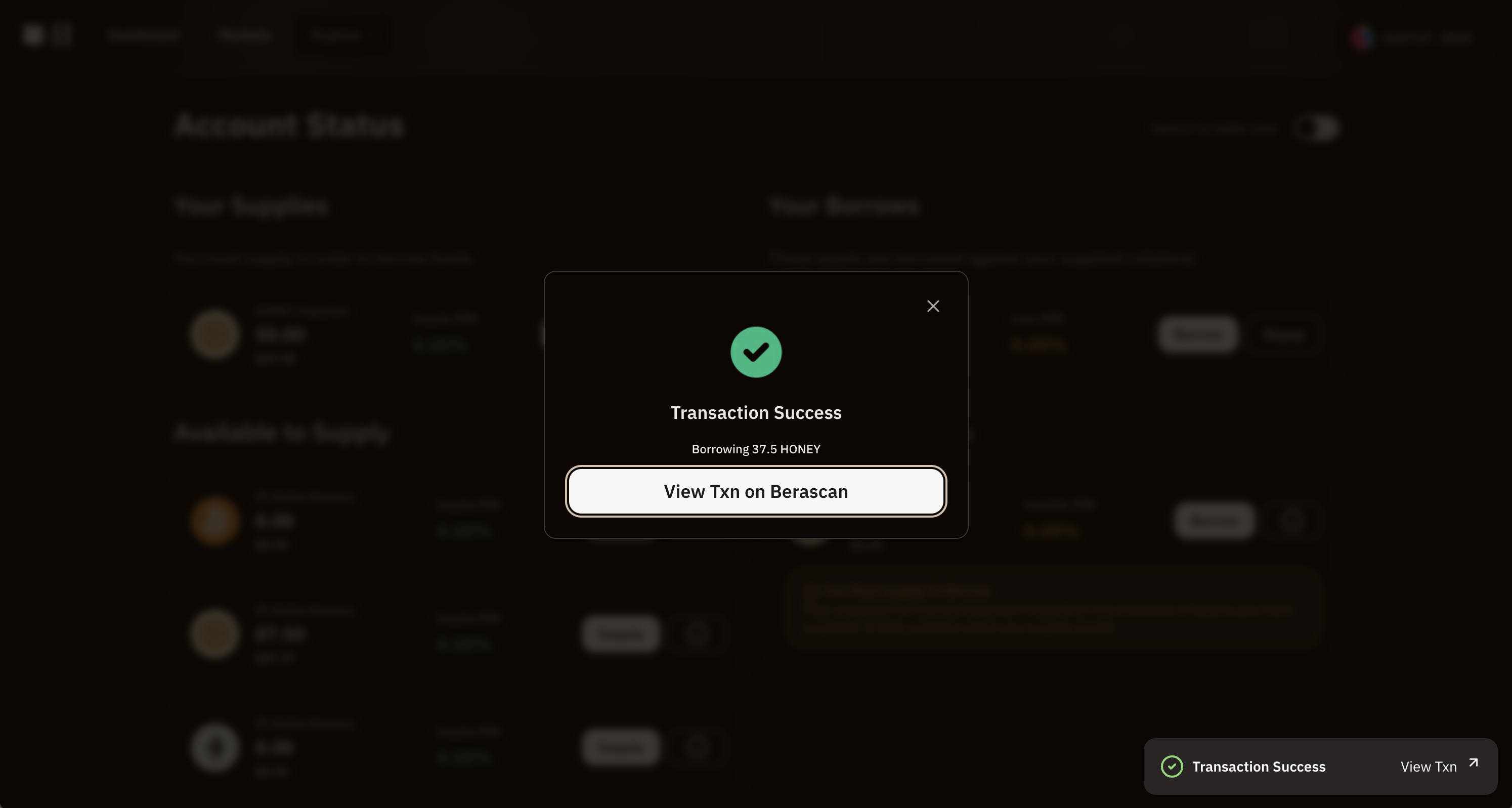

Borrow Completed

The transaction should be confirmed and the borrowed amount should be available in wallet balance

How much I can borrow?

There is a borrowing cap. If an asset hits the maximum number of loans allowed for it, that specific asset becomes unavailable for borrowing. The borrowing limit is determined by the value you have supplied and the current liquidity. For instance, you cannot borrow an asset if there isn't enough liquidity or if your health factor doesn't permit it.

What asset do I need to repay?

You repay your loan in the same asset you borrowed.

How much would I pay in interest?

The interest rate applicable to your borrowed assets is determined by the borrowing rate, which is influenced by the supply and demand dynamics of the asset. Additionally, the interest rate for a variable rate undergoes constant fluctuations. You can check your current borrowing rate at any time within the "Your Borrows" section of your dashboard.

What is the health factor?

The health factor serves as a numerical representation of the security of your deposited assets in relation to the borrowed assets and their underlying value. A higher value indicates a safer status for your funds in the event of liquidation. Once the health factor reaches 1, the liquidation of your deposits is initiated. A health factor below 1 is susceptible to liquidation. With a health factor of 2 (HF=2), the collateral value compared to the borrowed amount can decrease by half, or 50%. The health factor is influenced by the liquidation threshold of your collateral relative to the value of your borrowed funds.

What happens when my health factor is reduced?

The health factor adjusts based on the fluctuation in the value of your supplies. An increase in your health factor enhances your borrowing position by reducing the likelihood of reaching the liquidation threshold. Conversely, if the value of your collateralized assets against the borrowed assets decreases, the health factor decreases as well, elevating the risk of liquidation.

When do I need to pay back the loan?

The health factor adjusts based on the fluctuation in the value of your supplies. An increase in your health factor enhances your borrowing position by reducing the likelihood of reaching the liquidation threshold. Conversely, if the value of your collateralized assets against the borrowed assets decreases, the health factor decreases as well, elevating the risk of liquidation.

How do I payback the loan?

In order to payback the loan you simply go to the "Your Borrows" section of your dashboard and click on the "Repay" button for the asset you borrowed and want to repay. Select the amount to pay back and confirm the transaction.

For a more detailed guide check Repaying guide.

How do I avoid liquidation?

In order to avoid the reduction of your health factor leading to liquidation, you can repay the loan or deposit more assets in order to increase your health factor. Out of these two available options, repaying the loan would increase your health factor more.